Ratlinks: Making an April Fool of Yourself

New car, caviar, four star, daydream | Think I'll buy me a football team

THE WALL

April already? It feels like it was just 2019.

How is your path to mastery?

Can you now perform a complex task without making a special effort to think of its separate parts?

Struggling to best move toward mastery?

To put it simply, you must practice diligently, but you practice primarily for the sake of the practice itself. Rather than being frustrated while on the plateau, you learn to appreciate and enjoy it just as much as you do the upward surges.

The real juice of life, whether it be sweet or bitter, is to be found not nearly so much in the products of our efforts as in the process of living itself, in how it feels to be alive.1

SANCTION THIS

They lacked adequate practical understanding of how money and credit work, and I lacked adequate practical understanding of how politics and geopolitics work.

— Ray Dalio

The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) weaponized the financial system by imposing expansive economic measures, in partnership with allies and partners, that target the core infrastructure of the Russian financial system — including all of Russia’s largest financial institutions and the ability of state-owned and private entities to raise capital — and further bars Russia from the global financial system.2

Money drives the financial system but what is money?

Most money has no intrinsic value; it's not wealth; and while money printing isn't necessarily bad, central banks always end up devaluing and most currencies are ultimately destroyed.3

The ability to print money is known as seigniorage or a profit made by a government by issuing currency, usually the difference between the face value of the currency and its production costs.

There is big money in printing money and a reserve currency is probably the most important power to have, even more than military power.

Bretton Woods established a system of payments based on the dollar, which defined all currencies in relation to the dollar, itself convertible into gold, and above all, “as good as gold” for trade. U.S. currency was now effectively the world’s reserve currency, the standard to which every other currency was pegged.

On Sunday night, August 15, 1971, President Richard Nixon sat in the Oval Office staring into a television camera and addressed the nation: “I directed Secretary Connelly to suspend temporarily the convertibility of the dollar into gold.” After 27 years of relative monetary stability, the United States was breaking from the Bretton Woods system of fixed exchange rates that had tied the dollar’s value to gold.4

PRINTING MONKEY

Bored Ape Yacht Club launched under a year ago with a collection of 10,000 NFTs that cost roughly $200 to mint. These non-fungible tokens, created by Yuga Labs feature apes with varying characteristics like different fur colors, accessories, or background colors. At present, Bored Apes are worth a minimum of 101 Ether, or about $303,960, according to NFT exchange OpenSea.

On Friday evening March 12, Yuga Labs, maker of Bored Ape Yacht Club, announced it acquired the brands, copyright, and IP rights to the CryptoPunks and Meebits NFT collections from creator Larva Labs.

For the NFT community, it was the equivalent of Google buying Apple — or something. Suffice to say it was a mega-deal too stupendous to believe. Indeed, prior to the official announcement, holders of both NFTs voiced considerable skepticism about the rumored acquisition on the assumption it was simply too far-fetched to be true. Between them, Bored Ape Yacht Club and CryptoPunks are valued in the low single-digit billions — at a minimum5

For more on CryptoPunks see Ratlinks: You Down With NFTs

Things got even weirder when a related decentralized autonomous organization called ApeCoin DAO released ApeCoin crypto tokens featuring the Bored Ape Yacht Club logo.

Of the 1 billion tokens created that week (some of which are locked, to be released later) existing Bored Ape and Mutant Ape holders received 15%, or 150 million tokens, worth a cumulative $1.8 billion.

Each Bored Ape owner was given 10,094 “free” tokens, worth about $111,904 as of March 22nd, and each Mutant Ape owner was given 2,042 tokens, worth about $21,971. The Jane Goodall Legacy Foundation, a charity organization, received 1% of the launched coins.

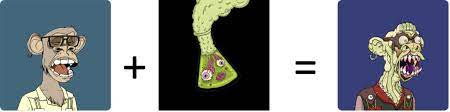

The ApeCoin distribution is in addition to two other Bored Ape “dividends”. First was an airdrop to Bored Ape owners of a Shiba Inu part of a series called Bored Ape Kennel Club (BAKC). The next distribution was a serum that when used on your ape mutated it into a member of the Mutant Ape Yacht Club (MAYC).6

Yuga Labs the creator of these blue-chip ape NFTs generated a 95% gross profit margin thanks to seigniorage baby! Popularity and huge margins helped Yuga raise a $450 million dollar “seed” round led by VC firm A16Z Crypto valuing the company at $4 billion dollars. The newly raised funds are earmarked to build a metaverse that makes all other metaverses obsolete.

IT’S A GAS

To recap, if you paid $200 for a picture of an ape in March 2021, at present you now have a digital picture of an ape, a digital picture of a dog, and a digital picture of a mutant ape along with a bunch of tokens and are quite rich. The seed investors received 14% of the total airdropped tokens, it was reported that A16Z invested about $250 million in Yuga and in turn received tokens worth about $1 billion.7

I remember when VCs would invest in companies creating unicorns with billion-dollar valuations. Now we have seed rounds returning a billion dollars within a week. This all makes perfect sense. If you own a few bored apes and are now diversifying, please consider this ape’s request to board your new yacht.

MONEY IS COOL BUT WHAT ABOUT PURPOSE

An American investment banker was taking a much-needed vacation in a small coastal Mexican village when a small boat with just one fisherman docked. The boat had several large, fresh fish in it.

The investment banker was impressed by the quality of the fish and asked the Mexican how long it took to catch them. The Mexican replied, “Only a little while.” The banker then asked why he didn’t stay out longer and catch more fish?

The Mexican fisherman replied he had enough to support his family’s immediate needs.

The American then asked, “But what do you do with the rest of your time?”

The Mexican fisherman replied, “I sleep late, fish a little, play with my children, take siesta with my wife, stroll into the village each evening where I sip wine and play guitar with my amigos: I have a full and busy life, señor.”

The investment banker scoffed, “I am an Ivy League MBA, and I could help you. You could spend more time fishing and with the proceeds buy a bigger boat, and with the proceeds from the bigger boat, you could buy several boats until eventually, you would have a whole fleet of fishing boats. Instead of selling your catch to the middleman you could sell directly to the processor, eventually opening your own cannery. You could control the product, processing and distribution.”

Then he added, “Of course, you would need to leave this small coastal fishing village and move to Mexico City where you would run your growing enterprise.”

The Mexican fisherman asked, “But señor, how long will this all take?”

To which the American replied, “15–20 years.”

“But what then?” asked the Mexican.

The American laughed and said, “That’s the best part. When the time is right you would announce an IPO and sell your company stock to the public and become very rich. You could make millions.”

“Millions, señor? Then what?”

To which the investment banker replied, “Then you would retire. You could move to a small coastal fishing village where you would sleep late, fish a little, play with your kids, take siesta with your wife, stroll to the village in the evenings where you could sip wine and play your guitar with your amigos.”8