MO MONEY MO PROBLEMS

When I was twelve years old I purchased my first watch, a Rolex. It wasn’t real. The year was 1997 and a school trip found me in the not-yet-gentrified still gritty parts of Lower Manhattan. Within minutes of breaking off from the group, a gentleman approached me. I looked at him with a face that said do you have any Rolexes? Twenty bucks later I was the proud owner of an oyster perpetual day date. From then on out every single time I heard Mo Money Mo Problems, I would throw my Rollie in the sky and wave it side to side.

It's All About The Scarcity, Baby

Let’s dial in. Rolex churns out just north of a million timepieces annually. Each watch, on average, commands a wholesale price of approximately $7,000. The specific rank order by value of all Rolex models can vary based on factors such as rarity, historical significance, demand among collectors, and market trends.

Among models like Dayjust, Day-Date, Submariner, or GMT it's clear that one model that undoubtedly stands tall in the pantheon of Rolex's most valuable and sought-after pieces is the Daytona. The Daytona's historical allure was further amplified by the Paul Newman Daytona, that became the most expensive wristwatch ever sold for $17.8 million.

Why Everyone Wants a Piece of the Action

Buying a Rolex used to be easy, but the emergence of cryptocurrency wealth has transformed the luxury market landscape, introducing a flood of new, affluent buyers. Crypto Bros boasting significant gains from Bitcoin and Ethereum, have evolved Rolex from a mere luxury symbol to a marker of their swift ascent in the financial world. Their entrance has added new faces to the luxury consumer base and escalated Rolex's appeal and demand to unprecedented heights, linking the brand's cachet directly to digital currency trends.

Predicting the Rolex market's trajectory is as precise as forecasting weather in the Bermuda Triangle but the outlook is stormy at best. WatchCharts Overall Market Index, which tracks prices has shown that prices of Rolex models have fallen 29% percent over 2 years.

TAPPING THE GRAY MARKET

Say you want to venture into the watch-buying labyrinth, there are two paths to acquisition: Authorized Dealers (ADs) and the grey market.

ADs are official resellers often jewelers who want you to develop a relationship or purchase history before you “get the call” for a new watch. The grey market, on the other hand, is the Wild West—an unregulated expanse offering immediate gratification but at a premium. This divide underscores a fundamental economic tension: the allure of convenience versus the cost of exclusivity.

Grey markets aren't confined to shiny Oyster cases, much like their name implies, the grey market occupies the nebulous space between the black and white of international commerce, manifesting across various industries, sprawling across sectors—from electronics and pharmaceuticals to fashion and automobiles—anywhere there's a notable price variance across borders or demand outstrips supply. These markets thrive on globalization's peculiarities, capturing value from the chasms between regional pricing and accessibility. These grey markets are notorious for sidestepping traditional distribution channels to offer consumers difficult access to products or services often at a steep cost.

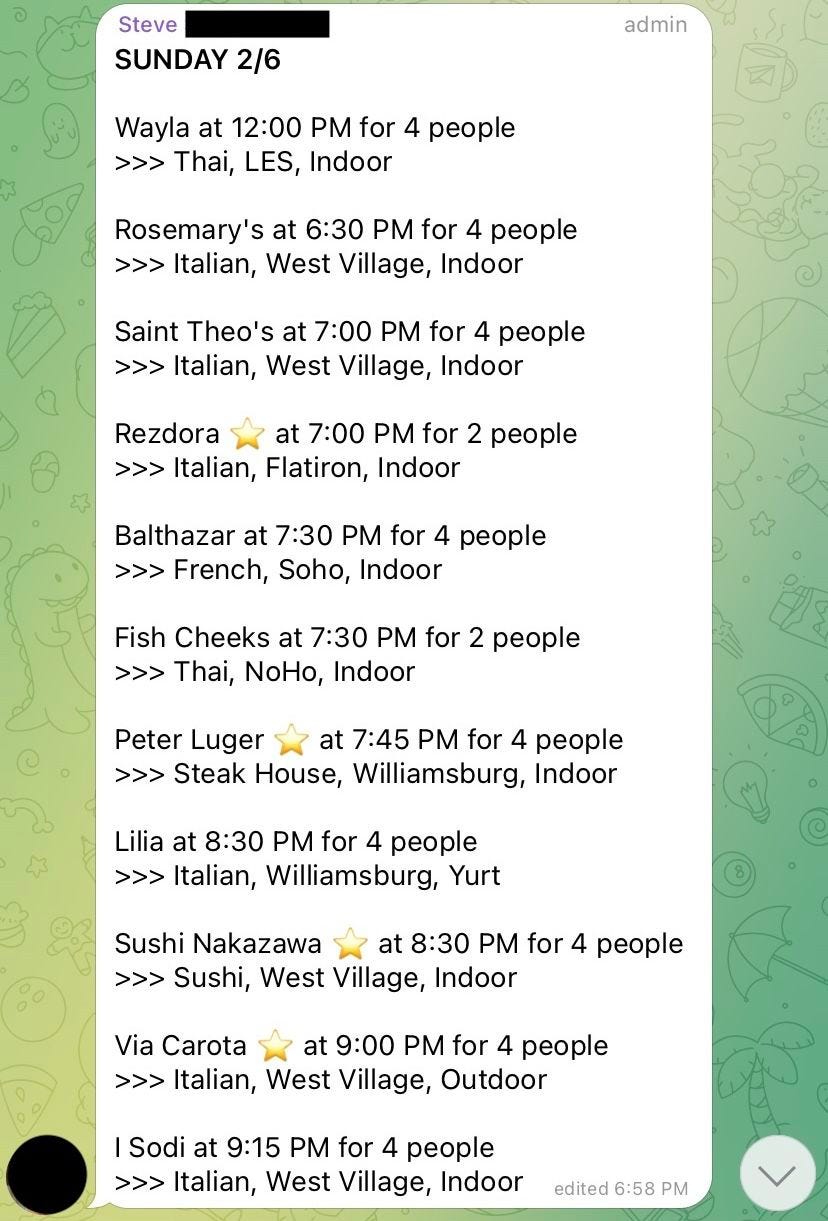

TABLE FOR TWO

Are you looking for a table at the hottest restaurant for a special occasion?

Do you happen to be a party of six rejected by every restaurant?

Are you upset that it seems like all the best reservations are always taken?

Since the pandemic, tough reservations have gotten even tougher. (One poll indicated that, during lockdown, people missed restaurants more than they missed their friends and family.) To sidestep the reservation scrum, particularly at a hundred and fifty of the city’s buzziest restaurants, a new squad of businesses, tech impresarios, and digital legmen has sprung up, offering to help diners cut through the reservation red tape, for a price. In the new world order, desirable reservations are like currency; booking confirmations for 4 Charles Prime Rib, a clubby West Village steakhouse, have recently been spotted on Hinge and Tinder profiles.

The reservation gray market began with the #FreeRezy movement, a free reservation-swapping group that grew to about 1000 people on telegram before Resy shut it down.

Today Appointment Trader and Cita Marketplace own the restaurant gray market, sitting at the nexus of supply and demand, digital innovation, and the sheer will of people to access otherwise unreachable dining experiences.

Who are the people who can get access to reservations that decide to sell it on a site like Appointment Trader?

Reservation flippers are a fascinating cross-section of society. There are those who meticulously hoard reservations through platforms like OpenTable or Resy, leveraging everything from family credit cards to concierge services, to others who employ more creative measures, including pretended affiliations with royalty or “script kiddies” who use bots to snatch up coveted slots.

Nicky DiMaggio runs a refuse business while moonlighting as a celebrity reservationist and operating the site www.goodtable.com. Restaurant insiders like maître d’s, hosts, or cooks as well as hotel concierges also sell tables on Appointment Trader, even if it means risking their jobs for quick cash.

Whatever the method, the aim is singular – to lock in a reservation that will then turn a tidy profit on this unique marketplace often at the expense of the restaurant where one to two no-shows often sink the night’s profitability.

One top seller, PerceptiveWash44 (#4 on the list above) makes reservations while watching TV.

He was standing outside the break room at the West Coast hotel where he works as a concierge. “It’s, like, some people play Candy Crush on their phone. I play ‘Dinner Reservations,’ ” he said. “It’s just a way to pass the time.” Last year, he made eighty thousand dollars reselling reservations. He also made almost two thousand reservations that never sold—a restaurateur’s nightmare.

The gray markets make life easier than what Steve Martin had to deal with in L.A. Story

ARBITRAGE OPPORTUNITIES ABOUND

Arbitrage is a financial strategy that seeks to exploit price discrepancies of the same asset or similar assets across different markets or forms to generate profit without risk.

Markets can be inefficient because human beings act irrationally. Arbitrage is possible due to varying supply and demand dynamics, differences in market information, or inconsistencies in how markets or individuals value assets. It plays a crucial role in financial markets by helping to ensure prices do not deviate substantially from their fair value for extended periods.

Arbitrage in the grey market exploits the price discrepancies of goods or services across different markets or regions to generate profit. This strategy hinges on the principle that the same item can have varying prices in different locations due to factors like supply and demand, taxation, currency exchange rates, and regulatory environments. Entrepreneurs leverage these differences to buy low in one market and sell high in another.

If you made it this far, maybe you want to get involved in a gray market business.

Each of these ventures relies on arbitrage opportunities and demand fluctuations. They typically don't require specialized knowledge or equipment, which lowers the barrier to entry. Additionally, the internet and global shipping services have made it simpler than ever to buy and sell goods across borders.

Secondary Ticket Sales: Buying tickets for concerts, sporting events, or theater shows and reselling them online through various platforms can be straightforward. The initial investment can be low, as it only requires purchasing tickets.

For more information on the economics of the ticket market please see Ratlinks: Tickets Please

Parallel Import/Export of Consumer Goods: This involves purchasing branded goods like clothing, electronics, or beauty products from a country where they are sold cheaper and selling them in another country where they are more expensive. This type of business can be started relatively easily, especially if you begin by focusing on small, lightweight items that are inexpensive to ship.

The key to this business is the ability to source a brand or product that is in demand directly from the manufacturer or at a discounted price.

Online Resale of Discounted Retail Goods: Many online and brick-and-mortar retailers have clearance sales or offer substantial discounts on various goods. A simple business model involves purchasing these discounted products and reselling them at a markup on online marketplaces like eBay, Amazon, or Facebook Marketplace. This has low barriers to entry and the potential for both local and international sales.

Textbook arbitrage remains one of my favorite trades. Purchasing books across many subjects for pennies on the dollar at the end of a semester only to resell them for almost full price at the start of the next semester.

Did you know one of the richest men in the world got his start selling books?