RATLINKS: THE ATTENTION DEFICIT

Where Carnival Barkers Meet Content Creators: Inside History's Most Addictive Market

HOW ATTENTION BECAME OUR MOST VALUABLE CURRENCY

The security guard at The Barnum Museum in Bridgeport, Connecticut gives me that universal look of "please don't touch the priceless artifacts" as I lean toward a glass case. "Everyone wants to see the circus memorabilia," he says, nodding toward the elaborate displays that dominate the room. "But that right there?" He points to a weathered leather ledger. "That's the real fortune-making machine."

He's not wrong. Between those pages lies something more valuable than circus history, P.T. Barnum's original blueprint for hacking human attention, written 150 years before terms like "engagement metrics" and "dwell time" would command billion-dollar valuations. While we're busy blaming Mark Zuckerberg for turning our brains into dopamine slot machines, the real architect of our distraction has been dead since 1891.

In the museum's café, visitors sit hunched over their phones, thumbs sliding across screens in an unconscious dance. A teenager nearby watches a video about Taylor Swift and NFL conspiracy theories, then another, then another. The algorithm knows exactly what it's doing.

Somewhere, Barnum is smiling.

WHO’S AFRAID OF LITTLE OLD ME?

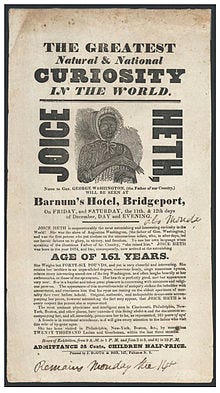

Barnum's genius was turning public skepticism into a marketing tool, as evidenced by one of his earliest and most controversial exhibits. Take the case of Joice Heth.

In 1835, Barnum exhibited Heth as George Washington's 161-year-old former nurse. When ticket sales began to lag, Barnum anonymously wrote to a newspaper suggesting she was actually a sophisticated automaton made of rubber and whalebone. Attendance doubled overnight. People paid twice to see the same attraction, desperate to spot the "truth."

This isn't just historical trivia it an the economic blueprint that’s built many billion-dollar valuations. A core product that hasn't changed in 200 years: capturing attention through manufactured intrigue, converting curiosity into currency.

As Barnum himself noted, "The noblest art is that of making others happy" a principle that today's attention merchants seem to have forgotten as they optimize for engagement rather than fulfillment.

Metrics track how long we watch, not whether we're glad we did.

THE DOPAMINE DEALERS

In 2017, Tristan Harris, a former Google Design Ethicist, testified before Congress about what he called "brain hacking." Speaking to senators, he explained how social media platforms had essentially turned smartphones into slot machines we carry in our pockets.

The testimony made headlines, but what happened next tells the real story: engagement metrics for these apps increased afterward.

Let's run some numbers that would make Barnum's head spin:

Attention isn't just personal, it's a collective resource we're depleting at an unprecedented rate. In economic terms, the global attention market isn't measured in hours but in billions of human hours.

When a viral video claims 10 million views at 3 minutes each, that's 500,000 hours of collective human attention, equivalent to 57 years of continuous viewing by a single person.

TikTok users spend an average of 95 minutes per day on the app, longer than it took to watch Barnum's entire circus show twice in the 1870s.

As reported in Netflix's Q4 2023 shareholder letter, Netflix users stream over 1 billion hours of content weekly, which equals roughly 182,000 years of continuous viewing, enough time to have watched the entirety of human civilization unfold, from the building of the pyramids to the present day, 36 times over

YouTube viewers consume over 1 billion hours of content daily (officially confirmed by YouTube in their press statistics), equivalent to 114,000 years of viewing every single day, more media than all audiences combined would have experienced during the entire 50-year run of Barnum's circus

Netflix CEO Reed Hastings revealed in 2017 that their biggest competitor wasn't Amazon or HBO, it was sleep. "When you watch a show from Netflix and you get addicted to it," he said, "you stay up late at night... We're competing with sleep, on the margin."

When your business model treats basic human needs as competition, you're not selling a product, you're engineering behaviors that rewire our most fundamental human rhythms.

But Barnum's attention merchants at least operated within the constraints of physical reality.

You had to buy a ticket, travel to a location, and spend a discrete amount of time under the big top.

What happens when the circus never leaves town, fits in your pocket, and has mathematically optimized its ability to keep you watching?

We find ourselves facing what economists might call...

THE GREAT ATTENTION CRASH

The numbers tell a story of abundance becoming an avalanche. When Substack launched in 2017, the average paid newsletter converted 5-10% of readers to subscribers. By 2024, that number had dropped to 1-2%.

We are drowning in content.

According to a 2024 study from the Attention Metrics Institute, the average American sees between 4,000-10,000 ads daily but only consciously processes about 100.

Content consumption rates have plateaued even as production increases exponentially. On TikTok, while total hours spent on the platform continue to rise, average watch time per video has declined 22% since 2021, we're sampling more but savoring less.

There are over 500 hours of video uploaded to YouTube every minute, 2 million blog posts published daily, and over 100 million photos and videos shared on Instagram daily.

Then AI entered the chat.

ChatGPT can generate a year's worth of blog posts in under an hour. Midjourney can create a lifetime's worth of artwork in a day.

We've entered an era of attention hyperinflation, where the supply of content is infinite but human attention remains stubbornly finite.

This creates what psychologist Barry Schwartz famously called "the paradox of choice," the counterintuitive discovery that more options actually make us less satisfied and more paralyzed.

In his research, Schwartz found that people presented with 24 jam options were one-tenth as likely to make a purchase as those shown just 6 options.

The same principle applies to our digital buffet. When faced with unlimited streaming options, we spend more time scrolling through possibilities than watching anything. When confronted with infinite TikTok videos, we become less engaged with each one. Our mental bandwidth doesn't expand to accommodate the excess, it fractures under the pressure.

In economic terms, we're witnessing the greatest resource crisis since the 1970s oil shock, only instead of petroleum, we're running out of decisiveness. And just like with oil, there are now attention oligarchs building vast fortunes by controlling what remains, not by giving us more choices, but by algorithmically removing our need to choose at all.

THE INTIMACY ECONOMY

On a random Tuesday in 2019, a pink-haired content creator named Belle Delphine posted a product that would make P.T. Barnum slow clap in admiration: "GamerGirl Bath Water" for $30 a jar. The internet lost its collective mind. The stock sold out in three days.

This wasn't just a stunt, it was an economic masterclass in attention arbitrage. Delphine understood something fundamental about the modern attention economy: in a world of infinite digital content, physical artifacts of digital fame become invaluable. The water itself was worthless; the story of owning it was priceless.

When Tim Stokely launched OnlyFans in 2016, critics dismissed it as just another social platform. What they missed was its revolutionary approach to the attention economy's oldest problem: how do you monetize parasocial relationships? Traditional social media platforms had mastered getting users to give away intimacy for free. OnlyFans figured out how to make them pay for it.

By 2023, OnlyFans had paid out over $10 billion to creators. For perspective, that's more than Spotify paid artists in its first seven years combined. The platform's top 1% of creators make more than 33% of all money, with some generating over $100,000 monthly, more than many pro athletes.

But here's where it gets fascinating: OnlyFans isn't selling content, it's selling the illusion of accessibility. Like Barnum's exhibits, the real product isn't what's being displayed; it's how it makes the audience feel. When a fan pays $50 for a custom message, they're not buying words, they're buying the feeling of being seen.

The platform's genius lies in what pop culture economists call "parasocial arbitrage" - monetizing the gap between digital intimacy and real connection.

While traditional celebrities maintain mystique through distance, digital creators sell precisely the opposite illusion, that of accessibility, familiarity, and reciprocity. The closer you feel to them, the more you'll pay, despite the fundamentally one-sided relationship.

It's Barnum's illusion perfectly remastered: selling the audience exactly what they want to believe is real, while winking right at them. The truth is irrelevant to the transaction.

Don't believe me?

It happens millions of times a day, algorithmically optimized, and ready to be billed to your credit card.

THE ALGORITHM ATE MY CHILDHOOD

Remember when discovering new music meant flipping through vinyl at record stores?

When finding a great restaurant required local knowledge rather than five stars on Yelp?

When entertainment options were limited enough that entire offices would discuss the same TV show the next morning?

That world is gone. The algorithm ate it.

Recommendation engines haven't just changed what we consume, they've rewired how we discover, how we decide, and ultimately, how we remember.

When Spotify's Discover Weekly serves you the perfect song you never knew existed, it feels like magic. But there's a hidden cost to algorithmic curation that economists are just beginning to quantify: the extinction of collective cultural experiences.

In 1983, the finale of MAS*H captured 106 million viewers, 60% of all American households with televisions. In 2024, the most-watched television event, the Super Bowl, reached 123 million viewers across all platforms combined, but that audience was fragmented across dozens of apps, streams, and social feeds, each experiencing a slightly different version optimized for their engagement profile.

We've traded the shared public square for personalized echo chambers, each algorithmically optimized to keep us watching, scrolling, and tapping just a little bit longer.

The result?

A kind of cultural hyperinflation where we're producing more content than ever before while sharing fewer cultural touchpoints than at any time in media history.

Just as monetary inflation devalues currency by flooding the market with too much money, cultural hyperinflation devalues content by flooding our feeds with too many options. And just as inflation widens wealth gaps, attention inflation widens cultural gaps, we're all consuming more but sharing less common ground.

THE NEW LAWS OF ATTENTION

In the attention economy, being ignored is worse than being hated, at least hate drives engagement.

In 2024, the path to profit isn't about building a better product, it's about occupying more mental real estate.

When MrBeast spent $3.5 million recreating Squid Game, he wasn't just making content. He was buying attention at wholesale and selling it back to advertisers at retail.

Each thumb scroll is a micro-auction for your consciousness. Each notification is a bid for your awareness. We think we're consuming content for free, but we're paying with fragments of our future memories.

What will we remember from 2024? Probably whatever the algorithms decided was worth our attention.

Take the Taylor Swift effect. Her appearance at an NFL game instantly shifts the attention economy's flow - jersey sales spike, ticket prices soar, and millions who've never watched football suddenly care deeply about the Kansas City Chiefs.

Modern fame is just attention with good SEO.

But here's the billion-dollar insight: attention isn't just getting more expensive, it's getting more elastic. A TikTok star can rival Disney's reach for the price of a ring light. An OnlyFans creator can out-earn a Netflix series with just an iPhone. The gatekeepers haven't disappeared; they've just been redistributed.

The next big play in tech isn't more content—it's less.

IN NICHES THERE ARE RICHES

The math here is fascinating. While mass market content creators fight over fractions of pennies per view, niche experts are building sustainable businesses with just thousands of true fans willing to pay premium prices.

As Kevin Kelly famously calculated, 1,000 true fans paying $100 annually generates a comfortable $100,000 income, no viral content required.

This isn't just a quirk of the newsletter world, it's what an economic pop-culturist could call the law of inverse mass appeal: as content supply approaches infinity, specialization becomes the only sustainable competitive advantage.

THE CALCULUS OF COOL

In 1997, sociologist Pierre Bourdieu identified what he called "cultural capital" the social assets that confer status beyond mere financial wealth.

What makes Supreme t-shirts worth $300 on resale markets isn't the fabric, it's the social signaling value of owning something that most people can't have.

Consider the lifecycle of cool:

Natural wine began as a rebellion by French vignerons against industrial wine certification before Brooklyn sommeliers transformed it into a $220 million market.

Vintage mechanical watches were worthless in the 1970s quartz crisis before becoming status symbols trading at 1000% premiums on waitlists today.

Even Crocs, once the ultimate anti-fashion statement worn by chefs and gardeners, became runway couture after collaborations with Balenciaga and limited-edition drops that sell out in minutes.

This pattern reveals the attention economy's universal equation of cool:

Cool = (Who Knows First) × (How Hard To Find) ÷ (Who Else Has It)

And if there's an equation for cool, there must be one for the engagement that drives the attention economy:

Engagement = (Emotional Reaction) × (Personal Relevance) ÷ (Effort Required)

Think about it this way: we've gone from a world where attention was abundant and content was scarce to exactly the opposite. The real value isn't in manufacturing artificial scarcity, but in creating something genuinely worth paying attention to and where the greatest fortunes are built not by reaching everyone with mediocrity, but by delivering something remarkable to those who truly appreciate the difference.

In a world of infinite content, people won't pay for access, they pay for relevance.

MONETIZING MINDFULNESS

As attention hyperinflation continues, we're witnessing the emergence of an intriguing market correction: attention minimalism. Digital detox retreats now command premium prices.

Apps that block distractions have millions of paying users. The irony isn't lost. People are paying to have less rather than more. Venture capitalists predict the next billion-dollar opportunity lies not in capturing attention but in creating spaces where focus is protected and cultivated. In a world of constant noise, silence becomes the ultimate luxury good.

Using vibecoding The Ratlinks team built Sanctuary, a focus marketplace where concentration becomes currency.

Unlike traditional productivity apps that merely block distractions, Sanctuary introduces real economic stakes.

Commit small amounts to focus sessions, challenge friends to focus on competitions, and earn real rewards for maintaining deep work.

Ready to join the focus revolution?

Turn your attention from a resource others exploit into an asset you control.

In an economy built on stealing your focus, what could be more revolutionary than owning it?

THE FINAL PLOT TWIST

As the museum closes, I take one last look at Barnum's artifacts before the guard ushers me out. Something catches my eye that I missed before. In a display of Barnum's writings, I spot what would become one of his most famous maxims: "Without promotion, something terrible happens... nothing!"

On the drive home, I pull into a gas station where a teenager is filming herself dancing next to pump #4 for TikTok. Behind her, three friends watch not her, but the phone screen showing her. The real performance is less important than its digital ghost.

Last week, while having dinner with friends, I noticed something disturbing. When one person left for the bathroom, the rest of us, without speaking or signaling, immediately reached for our phones. The absence of stimulation, even for 90 seconds, had become intolerable.

This isn't a technology story. It's not even a business story. It's a human story.

In 1974, economists coined the term "opportunity cost" the value of what you give up to get something else. But they never imagined the ultimate opportunity cost: what happens when we trade our finite attention for infinite content?

The greatest trick the attention economy ever pulled wasn't convincing us to watch. It was making us forget what it feels like to not be watching.

Last night, my screen time report showed 7 hours and 23 minutes. That's nearly half my waking hours spent inside the greatest show on earth, my phone.

P.T. Barnum famously said there's a sucker born every minute, but even he couldn't have imagined a world where we'd all volunteer to be the marks, the audience, and the performers in a 24/7 circus of our own making.

The most valuable resource in the modern economy isn't data, content, or even attention, it's meaning. And that's the one thing no algorithm can manufacture for us.

In the attention casino, everyone's playing, but the house always wins.

The question is what are you willing to pay to step outside the big top?