THIS IS THE GAME STOP

Before we begin a quick disclaimer: I am not a financial advisor and nothing here is financial advice.

Why the disclaimer?

If I tell you about a stock and it goes up YOU are a genius for buying it.

If the stock goes down I AM an idiot and you will never forget that I convinced you to buy something that dumb.

Today’s 24-hour news cycle feels like a 4-hour news cycle with the half-life of stories shortening to a break-neck pace.

The capital insurrection, that was January 6th. President Biden’s inauguration occurred just a few days ago and remember the kid from Home Alone he is 40 now.

At this pace, no one can blame you for having a bit of mental fatigue.

It is hard to step back and regain perspective, but try we must.

FLYWHEELS AND MOUSETRAPS

Once upon a time, there was a stock called Tesla. Tesla is more than just a stock it is actually a company that makes electric vehicles. Tesla’s business model doesn’t actually matter much.

No matter your familiarity with stocks or the stock market. What we are discussing here are not stocks. Of course, these are stocks in a purely academic sense, shares of equity that equate to a fractional ownership stake in a public company.

The stocks mentioned here are not representative of the true business value. Instead are pure abstractions. In lieu of the word stock, picture trading sardines, tulips, or magic beans.

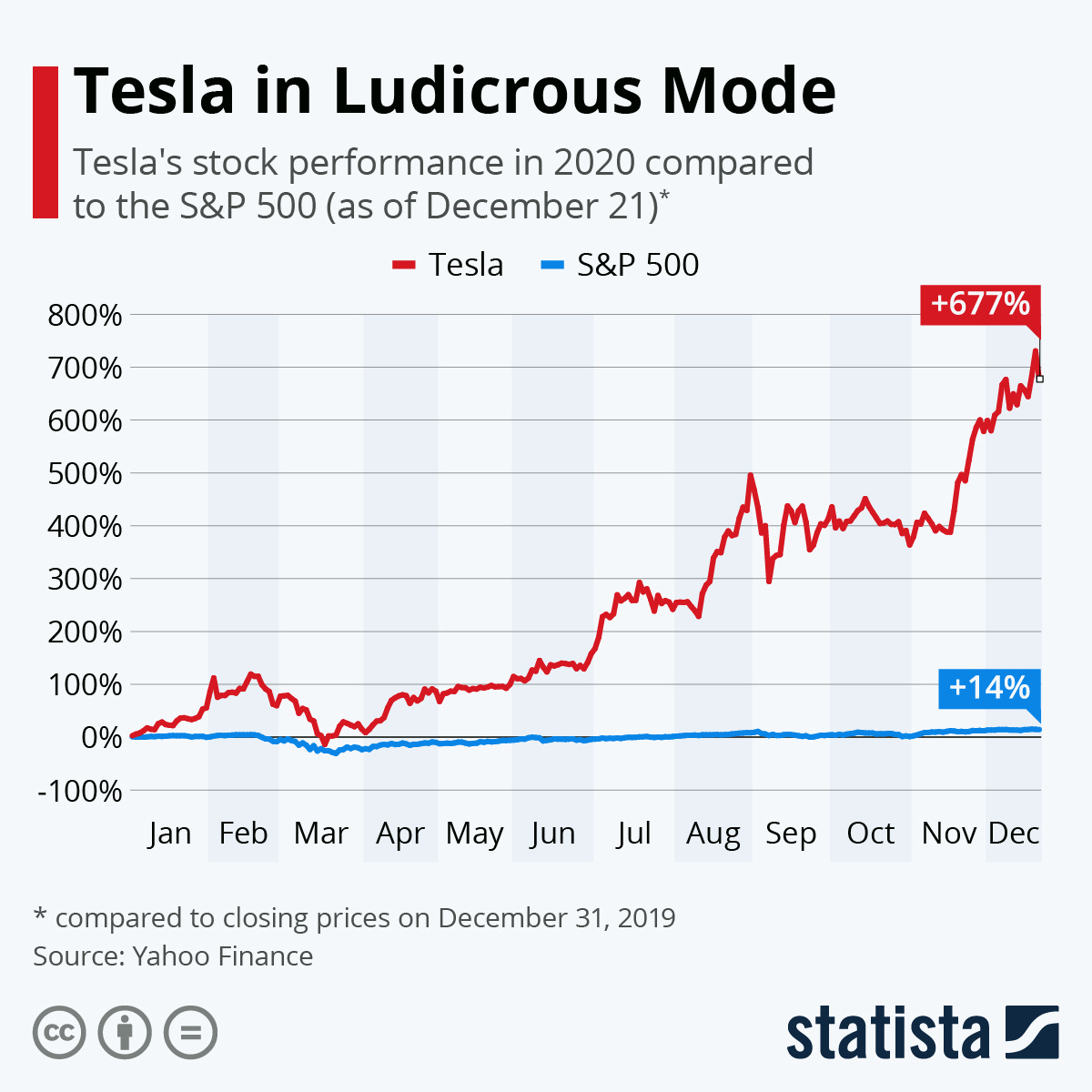

In 2020, Tesla’s stock price rise seemingly defied both gravity and logic. Eventually, the market cap became so large that it was deemed important enough to be added to a special club: The S&P 500 Index, a grouping of the top 500 US-listed companies.

The index has only 500 participants, so to add one company another must be removed. Usually, the two companies have roughly the same size market caps and passive index funds, the ones you likely own in your 401(k), have one goal - track the performance of the S&P 500 index.

Buying the entering participant and selling the existing one is very common and normally very little market impact occurs, but with Tesla, a weird thing happened.

As the largest index addition ever at 1.6% of the S&P 500, including Tesla in a short period of time could create volatility and tracking error. Standard and Poors came up with a workaround to give index funds more lead time to reposition their portfolios.

This quirk created a perverse effect.

Index funds started purchasing Tesla shares in anticipation of its addition to the S&P 500, “driving” the price up, further increasing Tesla’s weight in the S&P 500, “in turn” forcing index funds to buy more shares.

Buying that begets more buying created a feedback loop that pushed Tesla’s stock price higher and higher until Tesla was eventually added to S&P 500. Tesla is now the 4th largest component of the S&P 500 index at over 2%.

BEAR RAIDS

Much ink has been spilled over GameStop (ticker: GME). If for some reason you are unfamiliar, GameStop is a brick and mortar video game retailer that is expected to lose at least $2 per share this year. At one point GME traded near $500 per share because YOLO.

GameStop’s rapid ascent is similar to Tesla’s feedback loop.

Short sellers are investors who sell stock they do not own “short” in hopes to buy it back in the future at a lower price. Short sellers were so certain of GameStop’s demise that more shares were sold short than the total amount of shares outstanding.

Individual traders also known as retail investors, figured out the share issue and spread the word across a Reddit forum called Wall Street Bets. The message was simple: if everyone pitches in a little bit, this retail buying will “squeeze” the shorts forcing shares higher and higher until the hedge funds cry no mas.

Guess what?

It worked!

The buying in GameStop forced more buying pushing the stock price up rapidly. The stock spike then became the story, creating new interest and even more buyers. Becoming a snowball, that grows larger and larger as it rolls down the hill, eventually swallowing everything in its path.

Unfortunately, it will take a few months for Michael Lewis to write a GameStop book and even longer for Netflix to adapt it into a movie starring Jonah Hill.

Game Stoppers is the story of an overweight stonk trader living in his mom’s basement who mortgages his wife’s boyfriend’s house and refuses to sell a share of stock turning $50,000 into $15,000,000. That is until his brokerage, Robinhood changes the rules and he is forced to choose between profits or his morales.

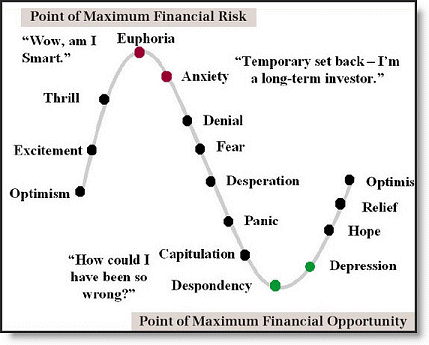

While it might appear stonks only go 🆙 let’s harken back to the Official Ratlinks 2021 Predictions on market cycles.

If you invested in GameStop, you have likely lived some or all this in under a week.

YOU COME TO ME ON THE DAY OF MY DAUGHTER’S ZOOM WEDDING

A few years ago, I bluffed my way into a meeting with a well know real estate billionaire.

During a working lunch, I saw this gentleman dining across the restaurant. While we have met before, there was little chance he would remember me given his stature and my lack thereof. The next day I sent him a note saying that I saw him at lunch and we should connect next time he is in NYC. Shockingly he replied with "Evan, I thought I saw you. Let's connect next time I am in town."

A month or so later, he returned to New York as the guest host on a morning news show. I followed up about a meeting. He promptly responded: My office 11 am.

Before I arrived I was unsure what was going to occur. After some initial awkwardness, the gentleman opened up touching on how he made his wealth and his philosophy of life.

Be contrarian.

It's hard being different or standing out from the crowd. While it can be scary in the moment, in the end, you are betting on yourself.

If you have nothing good to say it may be best to say nothing.

You should never assume the other party shares your view. Your comments can be harmful not only to the person you are discussing but also to the person you are talking to and even yourself.

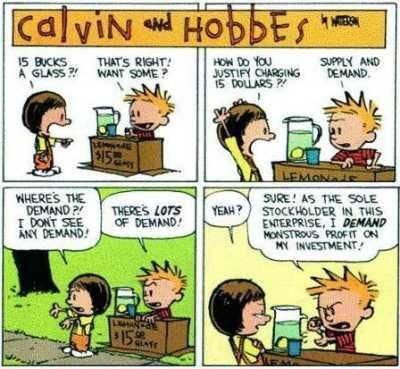

Focus on supply and demand in every situation.

If demand has increased, but competition (supply) hasn't. That is where you want to be.

THE GREAT WHITE WHALE

If you rode GME to a newfound fortune. Mazel!

Remember, bulls make money, bears make money, but pigs get slaughtered.

You didn’t buy Tesla or GameStop? How real is the FOMO? You want to jump in right now, don’t you?

In Ratlinks: Going Full Send in the Market we discussed this situation:

Face it. Everyone around you is getting rich and you aren’t.

We all know the feeling.

You can smell that sweet sweet moon money.

You want that yacht, you need those tendies.

This is not a new phenomenon, wether tulip-mania, tech stocks, bitcoin or GameStop shares.

Each iteration appears new, but it’s never different.

Pressure begins to build around you as everyone else is getting rich. If you are so smart why aren’t you too?

FOMO lead demand becomes a YOLO induced full send.

Eventually resolved through what is known in financial parlance, as a blow-off top or a buying climax. It develops as the end of a prolonged uptrend. It signals a change in the nature of the trend and shows a buying frenzy.

If you decide not to invest, you have to sit back as everyone else seemingly gets rich.

How will it feel when your doorman buys a Ferrari?

What are you to do then? Are you going to complain as you miss out on ANOTHER RECORD CLOSE?

Overpriced markets may have further to go but remember that the potential catalysts we have to worry about most may be the unknown ones.- Howard Marks

Just remember that by waiting this long, it is likely the second YOU jump in, YOU know the market is moving lower. Then again maybe it won’t. Caveat Emptor

One thing is for certain this won’t be the last financial mania, panic, or hysteria.

There will be another, there always is. The question is how soon? As Mark Twain famously said, history never repeats itself, but it does rhyme.

Enjoy your champagne and tendies!